Chapter 9 Chapter 7 How to Establish a Corporate Governance Mechanism to Protect Creditors

At present, a new concept of MBO is very popular in China.I'll start with leveraged buyouts (Leveraged Buy Outs, LBOs).What is LBO? LBO refers to a group of people, including company managers, who use bank financing or (junk) bonds to buy the outstanding shares of listed companies and become major shareholders.But if only the manager conducts LBO alone, it is called MBO.Hereinafter we call it LB〇.

First of all, I would like to point out that foreign research results show that LBO needs to buy outstanding stocks at a premium.For example, when KKR, a professional company in the United States, used LBO to acquire RJR Nabisco in 1986, they purchased all the outstanding shares of the company whose market price was only US$50 before LBO at a purchase price of US$106.Therefore, according to the research of DeAngelo, DeAngelo, Rice (1984), the profits of LBO companies will increase after LBO, otherwise they cannot support such a high stock price.And Kaplan (1989) also provided evidence to prove this statement. Bhagat, Shleifer, and Vishny (1990) proposed that the increase in the profits of these companies should come from the reduction of agency costs, because they found that the companies that completed the LBO immediately sold their non-main assets. We can say that due to the diversification of the company The result is that the stock price has fallen, so the action of selling non-major assets indicates that the company has the idea of planning for shareholders.It can also be said that the agent's cost is thus reduced.

Whether LBO is a long-term behavior or a short-term behavior has also caused some controversy in the academic circles. Jensen (1989) believed that LBO is a very efficient organizational form, therefore, it will form the mainstream of American companies in the future. Rappaport (1990) made the opposite statement. He believed that creditors such as banks would keep a close eye on these managers, and many parties would pick on the managers' work. Therefore, in the long run, they should not be attractive to managers. Kaplan (1991) did a lot of empirical research on this issue, and he found that LBO companies will go public again in about five years on average.Therefore, LBO is not a long-term practice.However, after the re-listing of these companies, the ratio of major shareholders' equity and bank debt is higher than that of LBO before.

But according to our previous analysis, LBO should be a short-term behavior. Therefore, the prerequisite for the success of LBO must completely depend on whether the company can work hard in the short term.And whether the bank can successfully recover the creditor's rights almost depends on whether the LBO company has enough good performance to go public again to raise funds to return to creditors.But according to my previous analysis, do readers think that our managers have sufficient fiduciary responsibilities to creditors?Asian families will exploit banks due to the imperfect legal system.Therefore, unless we have good regulatory measures, the implementation of LBO or MBO is quite dangerous for creditors, and this will be a new activity to rob creditors.

The idea of establishing a state-owned banking system in my country basically comes from Lenin's theory.A few days before the "October Revolution", Lenin published his views on the banks: "Without the big banks, socialism will be impossible, the big banks are the 'state apparatus' through which we need to achieve socialism , we can get it directly from capitalism..." (Lenin's 1917 speech reads as follows: "Without big banks, socialism would be impossible. The big banks are the 'state apparatus' which we need to bring about socialism, and which we take ready-made from capitalism...").

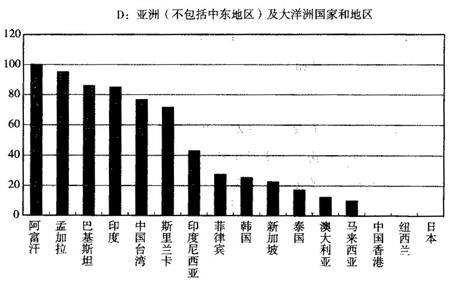

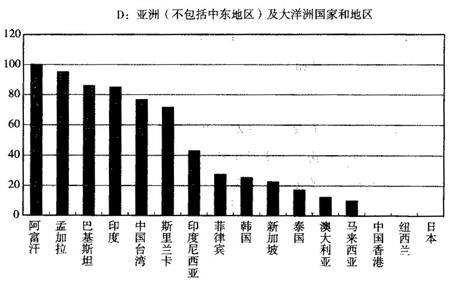

These views are widely accepted around the world. In Africa, Asia (such as China) and Latin America, governments nationalize existing commercial banks while starting and developing new ones. LaPorta, Lopezde, Silanes, Shleifer (2002), based on the data in 1996, made a comprehensive analysis of the ownership structure of the top 10 banks in 92 countries and regions around the world.

Figure 8 Top 10 bank holdings in each region

They found that among the 92 countries or regions in the world, the names of countries or regions without state-owned banks in each continent are as follows:

1. Asia - New Zealand, Japan, Hong Kong, China.

2. Africa - South Africa, Cyprus.

3. The Americas—United States, Canada.

4. Europe - Great Britain.

Only 8 of the 92 sample countries or regions in the world do not have state-owned banks. Therefore, I can say that state-owned banks are the norm, and private banks are the exception. This evidence is completely different from the thinking of ordinary people in China.

However, the state-owned banking system has brought the following problems:

1. The poorer the country - the stronger the government's control over bank ownership.

2. The more centralized the government - the stronger the government's control over bank ownership.

3. The more important the SOE - the stronger the government's control over bank ownership.

4. The less efficient the government - the more control the government has over bank ownership.

5. The less protection of property rights - the greater the government's control over bank ownership.

6. Less well-developed financial markets—government control over bank ownership.

This problem is also faced by our country's state-owned banks.There are so many countries implementing the state-owned banking system in the world, how does the state-owned banking system contribute to economic development?As a result, their research found the following conclusions:

1. Government-controlled banks have side effects on financial growth.

2. Government-controlled banks cannot accelerate capital accumulation (government-holding ratio increases by 10%, economic growth rate decreases by 0.2%).

3. Government-controlled banks cannot increase productivity (the ratio of government-controlled banks increases by 10%, and productivity decreases by 0.1%~0.15%).

The main reason is that the misdirection of resources caused by the government's holding of banks hurts productivity and economic growth.Of course, this is also the problem facing our country at present.

However, the current problems in China are very clear. If the state-owned banks are not reformed, the bank’s bad debt problem caused by the policy loans implemented in the past will not be resolved, and it may deteriorate rapidly and drag down the hard-won economic construction achievements.But in any case, the premise of reforming China's state-owned banking system is that the interests of creditors (which can be the state or individuals) must be guaranteed first, that is, we need to establish a corporate governance mechanism to protect creditors.And when it comes to protecting creditors, the first thing to do is to strengthen the supervision of banks.

Barth, Caprio, and Levine (2000) collected some national plans to reform banks and strengthen supervision, including:

1. Restrictions on Bank Underwriting of Securities

2. Restrictions on underwriting insurance by banks

3. Restricting banks from investing in real estate

4. Limit bank control of non-financial institutions

5. Restricting control of banks by non-financial institutions

They want to observe the impact of the implementation of these policies on the efficiency of banking operations and the development of the financial system, the growth of the non-financial system and the stock market, and the impact of banking crises.

The conclusions they drew were completely beyond everyone's expectations.The government's plan to strengthen supervision not only failed to achieve the original purpose of improving efficiency and stabilizing finance, but caused even worse negative effects.For example, restricting banks from underwriting securities and investing in real estate not only fails to increase the operating efficiency of banks, but reduces them; moreover, not only does not help to slow down the financial crisis, but instead increases it.At the same time, it has a negative impact on restricting banks' investment in real estate, on the development of the financial system, and on the growth of the non-financial system and the stock market.

Moreover, the government's plan to strengthen supervision is basically out of context.According to the research of Barth, Caprio, and Levine (2001), it was found that the banking crisis did not lead the government to formulate stricter regulations. Among the 250 banking crises that occurred in 63 countries or regions around the world, 141 of them were not affected during the crisis. During or after the end, the relevant laws and regulations have not undergone substantial changes; 14 times show that their relevant laws and regulations have weakened (2 of which are related to the crisis); only 3 times show that relevant laws and regulations have been strengthened; the other 92 times lack data.The data from these studies is astounding.Because not only did the program of increased regulation fail to achieve its original purpose, but governments around the world have little idea how to deal with the banking crisis.

And it's not just that the government doesn't know how to supervise banks, international organizations around the world, including academia and the World Bank, have hardly proposed reform policies specifically targeting banking structures, regulations, and supervision.Everyone only proposed some general reform plans, such as increasing transparency and opening up the financial market to introduce international financial institutions.These general reform plans are currently the subject of much discussion in China.

The evidence I present presents a major headache for our country's banking reform programme.At present, there is no guidance program in the world that can be referred to. Therefore, it is more difficult for our country's bank reform.

We can summarize the above discussion on the rights and interests of minority shareholders into Table 5.

The protection of small shareholders in the United States can be expressed as: strong government supervision + fiduciary responsibility + incentive contracts.However, due to historical reasons, the British government did not intervene in the stock market like the US government.As for the protection of stockholders in continental Europe, Canada, and Japan, they also mainly rely on "fiduciary duties", but this "fiduciary duty" tends to protect labor rather than stockholders, which is quite different from Britain and the United States.As for other countries in Asia, there is no so-called protection mechanism for stockholders at all, and there is only unlimited exploitation of small stockholders by large shareholders.Therefore, it is difficult to establish a truly healthy stock market in Asian countries.

Finally, I would like to discuss a question, can we bring the so-called "fiduciary responsibility" to Asia?

According to our previous discussion, "fiduciary responsibility" is a historical inheritance, and it cannot be learned.Our Asian countries have neither the driving force of the British 1533 "fiduciary duty" tradition nor the vigorous promotion of the government, so it is difficult to form an effective "fiduciary duty".The government's strong supervision and incentive contracts are relatively reliable.This is why I always shout that honesty and conscience come from harsh laws, that is, through strong government supervision, so that stock market participants will not be bullied or have no integrity.As for the managers of the company, they can use incentive contracts to combine their business goals with the interests of shareholders.

As for whether the Hong Kong region of China is based on the premise of protecting labor interests, that is a question worthy of discussion.But if we emphasize the interests of labor, then our stock market is unlikely to flourish like the United States, and the concentration of ownership will definitely form the dominance of the stock market in the future.

Personally, I never think that we need a prosperous stock market. What I want to see more is a society where wealth is shared with the people.In the current stock market, there is no "fiduciary responsibility", no effective supervision, and no incentive contract, which will only run counter to the ideal of "hiding wealth from the people".

We also summarize the issues discussed above in relation to the rights and interests of creditors in Table 6.

The form of creditors in Britain and the United States is still dominated by corporate bond creditors, independent banks and bank syndicates.According to research, increasing bank debt can not only stimulate managers to work harder, but also reduce excessive investment in bad companies.Therefore, debt is beneficial to shareholders.In addition, the legal system of Britain and the United States is also relatively in place for the protection of creditor's rights, which is also a positive help for the promotion of LBO.

However, the situation in continental Europe (mainly Germany) and Japan is different. Banks usually occupy a controlling position.Taking Germany and Japan as examples, limited academic research indicates that banks in Germany and Japan still have considerable restrictions on their client companies. For example, Japanese banks will charge more interest, and Japanese companies also prefer to issue corporate bonds to raise funds. It is not financed through banks within the group.In addition, German banks do not care much about the supervision of client companies, and may interfere with client companies' merger intentions to protect their own interests.

Although the legal systems in continental Europe and Canada are not as good as the UK and the US in protecting creditor's rights, they are still in place compared with Asian countries.But since these countries are basically socialist countries, it is unlikely to support LBO in favor of managers.As for other countries, the research is very lacking, so we can't talk too much.

The form of creditors in Britain and the United States is still dominated by corporate bond creditors, independent banks and bank syndicates.According to research, increasing bank debt can not only stimulate managers to work harder, but also reduce excessive investment in bad companies.Therefore, debt is beneficial to shareholders.In addition, the legal systems of the United Kingdom and the United States are relatively in place for the protection of creditor's rights.This is also a positive help to the implementation of LBO.

But the situation in continental Europe (mainly Germany) and Japan is different, and banks are usually in a holding position.Taking Germany and Japan as examples, limited academic research indicates that banks in Germany and Japan still have considerable restrictions on their client companies. For example, Japanese banks will charge more interest, and Japanese companies also prefer to issue corporate bonds to raise funds instead of Financing through banks within the group.In addition, German banks do not care much about the supervision of client companies, and may interfere with client companies' merger intentions to protect their own interests.

Although the legal systems in continental Europe and Canada are not as good as the UK and the US in protecting creditor's rights, they are still in place compared with Asian countries.But since these countries are basically socialist countries, it is unlikely to support LBO in favor of managers.As for other countries, the research is very lacking, so we can't talk too much.

Due to historical reasons, a large part of banks in Asian countries are related banks controlled by families. Therefore, it has also caused serious exploitation of banks by major shareholders.Since the legal system of Asian countries is not in place for the protection of creditor's rights, and because it is a family bank, the legalization is not very effective.All in all, Asian countries do not have the conditions to implement conditional LBO.

According to my previous analysis, creditors do not need the protection of corporate governance because the legal systems in Europe and the United States are relatively in place to protect creditors.Moreover, the relationship between banks and enterprises is relatively clear. Whether it is an independent bank or a holding bank, although there are minor problems of one kind or another, after all, the small flaws do not hide the big blessings. Banks and creditors in European and American countries generally It has played a relatively positive role in the economic development of the country.But Asia is completely different. Banks in Asia are basically family-related banks. Therefore, how to establish a corporate governance structure to protect creditors in Asia is urgent.But at present, there is no guidance program in the world that can be used as a reference. Therefore, it is more difficult to reform the governance structure of our country's banks.

At present, I have a vague feeling that the wave of state-owned bank agreement transfers that is currently being implemented in China is pushing us into the trap of family-controlled related banks in other Asian countries. I am worried that the state-owned enterprises in the past will exploit banks. However, it will artificially create a situation in which private enterprises replace state-owned enterprises and exploit creditors.I think we should face up to the seriousness of this problem.

Based on my previous analysis, the corporate governance structure to protect small shareholders can be improved through fiduciary responsibilities, incentive contracts and effective government supervision.Therefore, the establishment of a governance structure to protect small shareholders is relatively clear.But how to establish a governance structure to protect creditors is a completely different question, and there is currently no answer at all.Therefore, this is also the biggest problem that our national bank reform will face.

Figure 8 Top 10 bank holdings in each region