Chapter 4 Chapter 03 Rio Tinto's Iron Ore Negotiations: Why the US, Australia and Japan were defeated

Imperialism is the highest stage of capitalism

The basic feature of modern capitalism is the domination of monopoly alliances of the largest entrepreneurs.When such monopolies monopolize all the sources of raw materials, they are incomparably stronger.We have seen how desperately international alliances of capitalists try to deprive each other of all possibilities of competition, buying, for example, lands containing iron ore or oil resources, etc. ...The more capitalism is developed, the more scarce raw materials will be felt, the more intense the competition and the struggle for the pursuit of raw material production all over the world, and the more fierce the struggle to seize colonies. (Lenin: "Imperialism is the Highest Stage of Capitalism" People's Publishing House, April 2001, 3rd Edition, p. 72)

Why does the world's largest iron ore consumer have no right to speak at the negotiating table?

When we negotiate with any of them, their attitude is unimaginable, even if our demand is so large, it doesn't work.

Is iron ore increasingly scarce in the world?

Anyone who has been in the iron ore business knows that there is so much iron ore or iron ore, I even suspect it is as much as the sand on the seashore.

When global demand is sluggish, who makes iron ore companies so tough in the face of China's big orders?

That's why Australian companies are so rich and powerful when negotiating, and they don't give an inch.

How does Japan, a country with small resources, control the lifeline of the global mining industry?

Therefore, the Japanese don't care much about whether the price of iron ore rises or not. They don't care at all.

According to the information disclosed by the Bureau of Secrecy on August 9, 2009, China lost about 700 billion yuan in the iron ore transaction negotiations with Rio Tinto, which is a huge amount.So why are we at such a disadvantage when negotiating with foreign capital?It is no longer a question of buying, nor is it a question of simple negotiation.I think the crux of the problem is that we don't understand iron ore, or the rules of the game for international commodities.

In February 2008, Chinalco took a stake in the British company of the mining giant Rio Tinto, which shocked the world.The agreement, which was expected to total as much as US$19.5 billion, was torn up by Rio Tinto just four months later. In July 2009, when the protracted negotiations between China Iron and Steel Association and the world's three major mining giants reached an impasse, four people including Hu Stern from Rio Tinto's Shanghai office were arrested by the Shanghai Municipal Bureau of State Security on suspicion of stealing state secrets. In August, the case was handed over to the public security organ for alleged infringement of commercial secrets and commercial bribery.As the largest consumer of iron ore, China's steel industry consumes half of the world's iron ore production every year, so it needs Australia's high-quality and reliable ore supply.At the same time, as the world's largest iron ore exporter, Australia's iron ore companies should need China amidst the gloomy global economy.However, in China's dealings with Rio Tinto, everything does not seem to be operating according to normal business rules.So, behind the spy shadows, what influences the price of iron ore, and what kind of competition is hidden under the negotiating table?

For international bulk materials, including petroleum, iron ore, agricultural products, non-ferrous metals, etc., their pricing mechanism is very complicated and cannot be determined by a simple principle of supply and demand.I saw a recent report from the Iron and Steel Association, saying that we are the buyer and the demand side during the negotiation, and we should have the right to speak when we purchase such a large amount.In the end, it turned out that not only did we not have the right to speak, but others simply took whatever they wanted.The others I refer to are Rio Tinto, BHP Billiton and Vale, which are currently the world's three largest iron ore suppliers. When we negotiate with any of them, their tough attitude is unimaginable. Even if our demand is so huge, it doesn't work, they don't care, what to do.They even do not hesitate to risk the breakdown of the negotiations, but they do not change the rules. Why? First of all, we must figure out one of the most important issues, that is how the price of iron ore is determined.Do you think it is determined by supply and demand?When demand goes up, prices go up; when supply goes up, prices go down, right?Before August and September 2008, we also experienced terrible international inflation. Iron ore rose at a rate of more than 70%, more than 10%, and 90% for three consecutive years. ; The price of oil rose from 38 US dollars a barrel in 2004 to 147 US dollars a barrel in the second half of 2008; the price of agricultural products is also skyrocketing. Do you think this is determined by supply and demand?Anyone who has been in the iron ore business knows that there is so much iron ore or iron ore, I even suspect it is as much as the sand on the seashore.I've never seen it out of stock.How is this price determined?I think several leaders of our Baosteel made quite proper speeches in recent times, and they gradually understood that all this was manipulated by Wall Street.Do readers know?It is Wall Street that has really made a lot of money. All these phenomena, the sharp rise and fall of all bulk commodity prices, are basically subject to Wall Street. In fact, there are already many examples of us going out. For example, Hualing Steel Works in Hunan once acquired FMG Iron Ore in Australia. It acquired a 17.4% stake in FMG Iron Ore at an average price of 2.48 Australian dollars. After the acquisition is completed, I I believe they will find that the price of iron ore is beyond the control of FMG.The negotiation with Rio Tinto on the price of iron ore this time is also the same. The price of iron ore is not up to Rio Tinto to decide. What is the evidence? There are three main global iron ore suppliers, namely Australia's two giants Rio Tinto, BHP Billiton and Brazil's Vale.In 2008, FMG, Australia's third largest ore supplier, also participated in iron ore negotiations.China Valin Iron & Steel Group is the second largest shareholder of FMG Group. On August 17, 2009, CISA formally signed a half-year agreement with FMG.According to this agreement, the price of fine ore will drop by 35.02%, which is 3% lower than the price reached by Rio Tinto and BHP Billiton with Japanese and Korean steel companies at the beginning of the year.However, analysts believe that FMG is only a small-scale supplier. This six-month contract is more like a stopgap measure. It remains to be seen how effective it will be. The negotiations between CISA and international mining giants will continue.Many people place their hopes for CISA negotiations on the oversupply of international iron ore in the second half of 2009. According to historical analysis, who has the power to determine the price of iron ore?

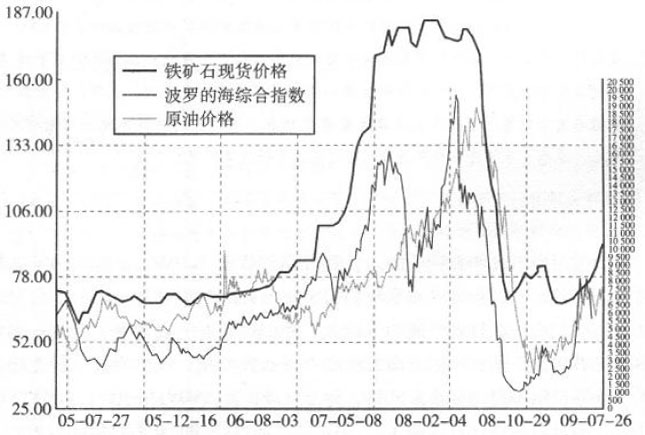

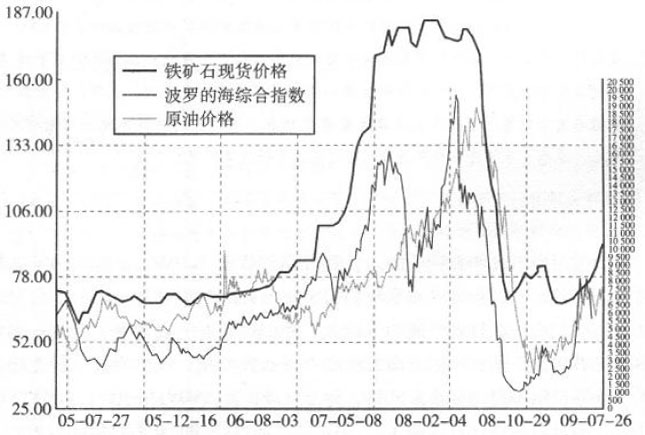

Let's take a look at Figure 3-1, which shows crude oil prices, the Baltic Composite Index (the so-called Baltic Composite Index is an index of freight charges) and iron ore spot prices.We can find that the price of iron ore fully includes the price of crude oil and the price of the Baltic Shipping Index.In other words, the iron ore price line is supported by two lines of crude oil and the Baltic Sea index. As long as these two lines go down, the iron ore price line will follow.If these two lines rise, the iron ore price line will be pushed up.In other words, the price of iron ore is basically determined by the Baltic Sea Index and crude oil prices.

Figure 3-1 Iron Ore Price, Baltic Composite Index and Crude Oil Price

Speaking of this, I believe all readers understand.What do you want to negotiate?You need to negotiate a lower price.Well, as long as the Baltic Index falls and crude oil prices fall, iron ore prices will fall.

Who sets the price of crude oil and the Baltic Index?It's up to Wall Street to decide.If you want to get cheap iron ore, you must go to Goldman Sachs and ask them to lower the price. As long as the price of crude oil and the Baltic Sea Index are lowered, the price of iron ore will inevitably decrease. This is the rule of the game.

On February 11, 2009, the Baltic Index broke through 2000 points in one fell swoop, reaching 2055 points.Compared with the index low of 663 points set on December 5, 2008, it more than tripled in just over two months.In the sluggish global economy, the answer to this strong reversal was found immediately, and that was iron ore shipped to China.As for the relationship between iron ore and other energy minerals, the world's largest mining group BHP Billiton CEO Gao Ruisi recently stated that the traditional long-term price agreement mechanism for international iron ore will be replaced sooner or later, and the transaction price of iron ore should transition to market pricing, just like oil Same as coal.It is not difficult to see that today, various international economic indexes and bulk materials are more and more correlated with each other, and their relationship with us is getting closer.So, who is behind these bulk materials and economic indicators?

I once told the staff of Valin Steel, I said that your acquisition of 17.4% of FMG's equity is very good, and it can also be said to be part of the success of our country's strategy of going global.But the question is, what are your benefits?They told me they could send a director.I say a director is useless.So what are the benefits of going out, and why should we go out?If the price is not determined by you, you will find that whether you buy Rio Tinto or FMG, the final price is still determined by Figure 3-1, and behind all this is the US government. Therefore, you will find that this negotiation is very difficult.Because the price of iron ore depends on the price of oil and the Baltic index, it is Wall Street that can really determine the price of oil and the Baltic index, and behind Wall Street is the US government.That's why Australian companies are so deep-pocketed when negotiating and don't budge.Because this is a strategic material, the U.S. government cannot make it marketable, and it is impossible for you to negotiate a price casually. This must be the final result of the struggle between international powers, and it is inevitable. Therefore, today's Steel Association negotiations are not simply a matter of supply and demand. Iron ore prices are usually manipulated through the Baltic Sea Index and oil prices, and behind it is the US government that supports Australia.So please tell me, what do you want to talk about?The media also told me, Professor Lang, we have made progress in this iron ore price negotiation. In the past, long-term agreements were all for one year, but this time we signed a half-year contract. After half a year, we will It's time to negotiate again.I said, believe it or not, the reason why it signs a half-year contract with you is that the price of iron ore will rise after half a year.As a result, it didn't take long for the price of oil to rise to $80 a barrel, the Baltic Sea Index to double, and the price of iron ore to soar.Don't you sign again after half a year? If you sign again, it will be a contract with a price increase.All of this is completely in the hands of the other party, and you have nothing to do. Why?Because you don't understand the rules of the game.So do we have any other way to get rid of it?I think the example of Japan can give us some reference. Next, I would like to talk about how Japan, which needs steel most, conducts negotiations. The annual iron ore price negotiations first started in 1981.In this negotiation process, after negotiations between suppliers and consumers, the two parties determine the iron ore price for a fiscal year.According to the traditional negotiation habits over the years, the international iron ore market is divided into the Asian market and the European market, and the Asian price and the European price are determined respectively.The Asian market is mainly represented by Japan, while the European market is represented by Germany. On May 26, 2009, Australia's Rio Tinto announced that it had reached the initial price of 2009 global iron ore negotiations with Japan's Nippon Steel, in which the price of fine ore was reduced by 32.95%.In China, the negotiations that started in November 2008 have been at a stalemate; until June 30, 2009, the final deadline for iron ore negotiations in 2009, the three international iron ore giants finally failed to accept the China Iron and Steel Association. 40% discount on request.Why did the negotiations between Rio Tinto and Japan go so smoothly, and how did the Japanese steel companies negotiate?

Japan is different from us. We have a lot of large and small steel mills. The top three steel mills only account for 15% of the market share; the top three steel mills in South Korea account for 89% of the total market share; and the top three steel mills in Japan The market share of steel mills is 67%.Moreover, there is only one steel factory in South Korea that can be imported, which is called Pohang Iron and Steel Factory, and there are five steel factories in Japan.And we have many steel mills, not only many large steel mills, but also many small steel mills. There are 38 small steel mills bypassing the Iron and Steel Association and going to negotiate on their own.That's what we do, and it's no surprise because we don't understand the rules of the game. I have explained the pricing process earlier, so I ask, after understanding the pricing process, what should you do?This is no longer a simple matter of continuing to negotiate with Australia. I hope the espionage case announced by the Bureau of Secrecy is indeed true, otherwise the consequences will embarrass us.But this is not a problem that can be solved by a spy case, but a problem of how we can protect ourselves under this mechanism. If I ask which country is resource-poor, I believe that the intuition of readers will definitely think that it is Japan.So, readers, think about it, even if you think it is Japan, don’t the Japanese themselves know it?If Japan knew that it was a resource-poor country, what would Japan do? 40 years ago, investing in mines was very risky, because the two camps of the East and the West mainly conducted trade transactions within their respective territories. For example, the Soviet bloc and the American bloc did not trade with each other. transactions within.But the development of western countries has come to an end 40 years ago, the highways that should be built, the railways that should be built, and the ships that should be built have also been built, so they have no demand for mineral resources.Therefore, the situation at that time was that whoever owned the mine had the greatest risk.Because firstly there is no need; secondly, the journey is extremely far away. Can you imagine that 40 years ago, you wanted to go to Australia to mine? What was the concept?It is too far away to imagine, and Australian workers like to go on strike, which is very troublesome.There is no market demand, workers like to go on strike, the distance is long, and mining is difficult. It is simply asking for trouble. So investing in resources at that time, including iron ore, was a very risky industry.Therefore, when choosing to invest in mines at that time, companies without an adventurous spirit would not dare to do so, and Japan attacked at that time. Japan is an island country poor in mineral resources.According to relevant data, there are only 12 kinds of minerals in Japan, but as a big economic country, Japan's demand for most mineral products ranks among the top in the world.Many important minerals, Japan is the world's largest or second largest importer.Japan also has a very special and advantageous position in iron ore negotiations.According to the analysis, Japan's position in the global mineral industry today is related to its 40-year overseas resource development policy, which is not only long-term stable, long-term, but also well-organized.So, how did Japan start this development plan?

According to the information on the website of Mitsui & Co., Ltd. of Japan, Mitsui & Co., Ltd. has actively participated in the investment and development of iron ore resources since the 1960s, that is, 40 to 50 years ago.Just when the risk of investing in mineral resources is so great, it has already begun to be developed.In order to obtain a long-term stable supply of iron ore, in 2003, Mitsui & Co., Ltd. acquired a 15% stake in the parent company of Brazil's Vale, the world's largest iron ore, and continued to expand its cooperation with Australia's Rio Tinto and BHP Billiton. ore business.Based on the shareholding ratio owned by Mitsui & Co., Ltd., its current holding output has jumped to the fourth place in the world.That is to say, 40 or 50 years ago, when the demand in the West began to plummet and it was generally believed that mines had no economic value, the Japanese had already begun to enter this market.The Japanese began to purchase iron ore in large quantities. In fact, it was not as simple as purchasing, but they cooperated with the local government to develop and benefit together. So when did we start?We only started buying foreign iron ore in 2002.Every time former Australian Prime Minister Howard visited China, he brought iron ore manufacturers with him, hoping that the Chinese government would buy their iron ore.At that time we were self-sufficient and did not need to import much, but after 2002, the situation was different. Since China has become a big manufacturing country, the demand for iron ore has risen sharply. Therefore, we began to enter this market, and because we did not understand the rules of the game, we suffered a lot of losses. For example, in the case of Rio Tinto, we lost 700 billion yuan .But when we entered the iron ore market in 2002, we didn't understand these at all. Don't say we didn't understand them at the time, we still don't understand them today.Let’s look at the Japanese again. The Japanese entered the industry 40 or 50 years ago when mining resources were a depressed industry.So what is Japan's strategy? Since Japanese iron and steel enterprises have already established a close relationship with the world's major iron ore producers through shareholding and other means, the price of iron ore has continued to rise in recent years, and Japan, an iron ore importer, has even Played the role of pusher.In contrast, China, as the world's largest steel producer, not only has a difficult iron ore negotiation process, but also the average cost of steel mills is 50% higher than that of Japan and Europe.So, how does Japan solve the cost problem in the face of rising prices?In terms of negotiation mechanism, what is the difference between China and Japan?

Japan's strategy is this, they have five steel companies with smelters, but mind you, who are they negotiating with?Steel mills do not negotiate, but trading companies negotiate.There are two trading companies, one is Mitsui & Co., which I just mentioned, and the other is Itochu Trading Company.Mitsui and Itochu are responsible for negotiations with Rio Tinto and BHP Billiton, and Mitsui and Itochu are responsible for sales. Iron and steel enterprises are only responsible for production, so what is the benefit?Mitsui and Itochu have already controlled the price of upstream iron ore, and are also responsible for downstream sales. A large part of steel, called special steel, is sold to China. This is the efficient integration of upstream, midstream, and downstream industrial chains.If the price of iron ore rises and Mitsui and Itochu make money, they will pass some of the profits from the upstream to the steel mills and will not let the steel mills lose money.Then through downstream sales, sell those high-tech products that we can't make, such as special steel, to China, and pass on some of the losses of the steel mills to the downstream.This is how they are integrated. In other words, Japanese trading companies and steel companies are an alliance.What if the price of iron ore falls, steel companies make money, and trading companies lose money?The trading companies are subsidized by steel companies.If the price of iron ore rises and the trading company makes money, the trading company will subsidize the iron and steel enterprises.Through mutual subsidy within the group, each member is guaranteed not to suffer losses.Therefore, the Japanese don't care much about whether the price of iron ore rises or not. If you want to rise, you can go up.And according to the global iron ore pricing mechanism established in 1981-I don't know who stipulated this mechanism, but I now think it is a great conspiracy. According to this pricing mechanism, from the fourth quarter of each year At the beginning, the world's major iron ore suppliers negotiated with customers, and as long as a steel mill reached an agreement, the negotiation ended.And our data shows that Japanese companies are usually the first to reach an agreement. For example, on February 22, 2005, Japan's Nippon Steel and Vale unilaterally reached an agreement to increase the price of iron ore by 71.5%. After the negotiation was over, steel mills all over the world, including China, had to raise their prices according to this agreement. On February 18, 2008, Nippon Steel reached an agreement with Vale to increase prices by 65%, which once again forced Chinese companies to accept such a huge price increase.They raise the price of iron ore, the trading company makes money, and subsidizes the losses of the steel mills; many special steels in Japan are sold to us, and they pass the cost on to China through the price increase of downstream sales. This is what they do.So they don't care about price increases at all, because they have established this alliance as early as 40 or 50 years ago, and through mutual subsidies between trading companies and steel mills, they can safely survive every price increase.Whether the price of iron ore rises or falls, they all make money.This is the strategy that Japan outlined 40 or 50 years ago. What about us?Our Steel Association represents the big steel mills, and there are dozens of small steel mills working on their own.The steel mills are in charge of negotiations, and the steel mills are in charge of sales. Those in charge of negotiations do not understand the rules of the game, how the price of iron ore is determined, or even that the United States is the biggest controller behind it.Therefore, we can’t talk about it. The price of iron ore has increased, and the cost of our steel mills has risen. However, most of the steel we produce is low-to-medium-grade steel, which has no technical content, so we have no bargaining power. It is difficult to raise prices for downstream sales, so In the end suffered a loss. We are completely passive because we have not formed a mechanism like Japan.Why is there no formation mechanism?Because we have always been intoxicated by our reputation as a resource-rich country, we think we have a vast land and resources, and never thought that today, the real resource-poor country is China, not Japan.If not, how could we be so passive in this negotiation?How could a small Rio Tinto cost China 700 billion yuan? According to the usual practice, Rio Tinto and Nippon Steel reached a benchmark price reduction of 33% in the fourth quarter of 2008, and steel mills all over the world, including China, must accept this price reduction.However, the steel association’s subsequent negotiations were dissatisfied with Rio Tinto’s decision to lower the benchmark price by 33%, and believed that China should be lowered even more. Spot prices for imported iron ore.Moreover, our Iron and Steel Association also used our Chinese ability to go through the back door and dig through the wall, bypassing Rio Tinto and directly finding Brazil's Vale to buy iron ore.This is an approach that does not understand the rules of the game. Readers, please think about it. Rio Tinto, BHP Billiton and Vale are of course in the same position. How could we allow us to go through the back door?In the end, Vale blatantly slapped the steel association through the media, announcing that it would not accept the steel association's negotiation. On November 10, 2009, Rio Tinto pointed out that the spot price in China has already been 27% higher than the benchmark price, and this fact will become the basis for next year's negotiations.This signal once again confirmed the previous statement that the three giants demanded a 30% price increase in iron ore negotiations, and once again slapped the Iron and Steel Association for the second time.I would like to ask the Iron and Steel Association, who gave you the power not to negotiate in a fit of anger, thus causing huge losses to our country?

For international bulk materials, including petroleum, iron ore, agricultural products, non-ferrous metals, etc., their pricing mechanism is very complicated and cannot be determined by a simple principle of supply and demand.I saw a recent report from the Iron and Steel Association, saying that we are the buyer and the demand side during the negotiation, and we should have the right to speak when we purchase such a large amount.In the end, it turned out that not only did we not have the right to speak, but others simply took whatever they wanted.The others I refer to are Rio Tinto, BHP Billiton and Vale, which are currently the world's three largest iron ore suppliers. When we negotiate with any of them, their tough attitude is unimaginable. Even if our demand is so huge, it doesn't work, they don't care, what to do.They even do not hesitate to risk the breakdown of the negotiations, but they do not change the rules. Why? First of all, we must figure out one of the most important issues, that is how the price of iron ore is determined.Do you think it is determined by supply and demand?When demand goes up, prices go up; when supply goes up, prices go down, right?Before August and September 2008, we also experienced terrible international inflation. Iron ore rose at a rate of more than 70%, more than 10%, and 90% for three consecutive years. ; The price of oil rose from 38 US dollars a barrel in 2004 to 147 US dollars a barrel in the second half of 2008; the price of agricultural products is also skyrocketing. Do you think this is determined by supply and demand?Anyone who has been in the iron ore business knows that there is so much iron ore or iron ore, I even suspect it is as much as the sand on the seashore.I've never seen it out of stock.How is this price determined?I think several leaders of our Baosteel made quite proper speeches in recent times, and they gradually understood that all this was manipulated by Wall Street.Do readers know?It is Wall Street that has really made a lot of money. All these phenomena, the sharp rise and fall of all bulk commodity prices, are basically subject to Wall Street. In fact, there are already many examples of us going out. For example, Hualing Steel Works in Hunan once acquired FMG Iron Ore in Australia. It acquired a 17.4% stake in FMG Iron Ore at an average price of 2.48 Australian dollars. After the acquisition is completed, I I believe they will find that the price of iron ore is beyond the control of FMG.The negotiation with Rio Tinto on the price of iron ore this time is also the same. The price of iron ore is not up to Rio Tinto to decide. What is the evidence? There are three main global iron ore suppliers, namely Australia's two giants Rio Tinto, BHP Billiton and Brazil's Vale.In 2008, FMG, Australia's third largest ore supplier, also participated in iron ore negotiations.China Valin Iron & Steel Group is the second largest shareholder of FMG Group. On August 17, 2009, CISA formally signed a half-year agreement with FMG.According to this agreement, the price of fine ore will drop by 35.02%, which is 3% lower than the price reached by Rio Tinto and BHP Billiton with Japanese and Korean steel companies at the beginning of the year.However, analysts believe that FMG is only a small-scale supplier. This six-month contract is more like a stopgap measure. It remains to be seen how effective it will be. The negotiations between CISA and international mining giants will continue.Many people place their hopes for CISA negotiations on the oversupply of international iron ore in the second half of 2009. According to historical analysis, who has the power to determine the price of iron ore?

Let's take a look at Figure 3-1, which shows crude oil prices, the Baltic Composite Index (the so-called Baltic Composite Index is an index of freight charges) and iron ore spot prices.We can find that the price of iron ore fully includes the price of crude oil and the price of the Baltic Shipping Index.In other words, the iron ore price line is supported by two lines of crude oil and the Baltic Sea index. As long as these two lines go down, the iron ore price line will follow.If these two lines rise, the iron ore price line will be pushed up.In other words, the price of iron ore is basically determined by the Baltic Sea Index and crude oil prices.

Figure 3-1 Iron Ore Price, Baltic Composite Index and Crude Oil Price

I once told the staff of Valin Steel, I said that your acquisition of 17.4% of FMG's equity is very good, and it can also be said to be part of the success of our country's strategy of going global.But the question is, what are your benefits?They told me they could send a director.I say a director is useless.So what are the benefits of going out, and why should we go out?If the price is not determined by you, you will find that whether you buy Rio Tinto or FMG, the final price is still determined by Figure 3-1, and behind all this is the US government. Therefore, you will find that this negotiation is very difficult.Because the price of iron ore depends on the price of oil and the Baltic index, it is Wall Street that can really determine the price of oil and the Baltic index, and behind Wall Street is the US government.That's why Australian companies are so deep-pocketed when negotiating and don't budge.Because this is a strategic material, the U.S. government cannot make it marketable, and it is impossible for you to negotiate a price casually. This must be the final result of the struggle between international powers, and it is inevitable. Therefore, today's Steel Association negotiations are not simply a matter of supply and demand. Iron ore prices are usually manipulated through the Baltic Sea Index and oil prices, and behind it is the US government that supports Australia.So please tell me, what do you want to talk about?The media also told me, Professor Lang, we have made progress in this iron ore price negotiation. In the past, long-term agreements were all for one year, but this time we signed a half-year contract. After half a year, we will It's time to negotiate again.I said, believe it or not, the reason why it signs a half-year contract with you is that the price of iron ore will rise after half a year.As a result, it didn't take long for the price of oil to rise to $80 a barrel, the Baltic Sea Index to double, and the price of iron ore to soar.Don't you sign again after half a year? If you sign again, it will be a contract with a price increase.All of this is completely in the hands of the other party, and you have nothing to do. Why?Because you don't understand the rules of the game.So do we have any other way to get rid of it?I think the example of Japan can give us some reference. Next, I would like to talk about how Japan, which needs steel most, conducts negotiations. The annual iron ore price negotiations first started in 1981.In this negotiation process, after negotiations between suppliers and consumers, the two parties determine the iron ore price for a fiscal year.According to the traditional negotiation habits over the years, the international iron ore market is divided into the Asian market and the European market, and the Asian price and the European price are determined respectively.The Asian market is mainly represented by Japan, while the European market is represented by Germany. On May 26, 2009, Australia's Rio Tinto announced that it had reached the initial price of 2009 global iron ore negotiations with Japan's Nippon Steel, in which the price of fine ore was reduced by 32.95%.In China, the negotiations that started in November 2008 have been at a stalemate; until June 30, 2009, the final deadline for iron ore negotiations in 2009, the three international iron ore giants finally failed to accept the China Iron and Steel Association. 40% discount on request.Why did the negotiations between Rio Tinto and Japan go so smoothly, and how did the Japanese steel companies negotiate?

Japan is different from us. We have a lot of large and small steel mills. The top three steel mills only account for 15% of the market share; the top three steel mills in South Korea account for 89% of the total market share; and the top three steel mills in Japan The market share of steel mills is 67%.Moreover, there is only one steel factory in South Korea that can be imported, which is called Pohang Iron and Steel Factory, and there are five steel factories in Japan.And we have many steel mills, not only many large steel mills, but also many small steel mills. There are 38 small steel mills bypassing the Iron and Steel Association and going to negotiate on their own.That's what we do, and it's no surprise because we don't understand the rules of the game. I have explained the pricing process earlier, so I ask, after understanding the pricing process, what should you do?This is no longer a simple matter of continuing to negotiate with Australia. I hope the espionage case announced by the Bureau of Secrecy is indeed true, otherwise the consequences will embarrass us.But this is not a problem that can be solved by a spy case, but a problem of how we can protect ourselves under this mechanism. If I ask which country is resource-poor, I believe that the intuition of readers will definitely think that it is Japan.So, readers, think about it, even if you think it is Japan, don’t the Japanese themselves know it?If Japan knew that it was a resource-poor country, what would Japan do? 40 years ago, investing in mines was very risky, because the two camps of the East and the West mainly conducted trade transactions within their respective territories. For example, the Soviet bloc and the American bloc did not trade with each other. transactions within.But the development of western countries has come to an end 40 years ago, the highways that should be built, the railways that should be built, and the ships that should be built have also been built, so they have no demand for mineral resources.Therefore, the situation at that time was that whoever owned the mine had the greatest risk.Because firstly there is no need; secondly, the journey is extremely far away. Can you imagine that 40 years ago, you wanted to go to Australia to mine? What was the concept?It is too far away to imagine, and Australian workers like to go on strike, which is very troublesome.There is no market demand, workers like to go on strike, the distance is long, and mining is difficult. It is simply asking for trouble. So investing in resources at that time, including iron ore, was a very risky industry.Therefore, when choosing to invest in mines at that time, companies without an adventurous spirit would not dare to do so, and Japan attacked at that time. Japan is an island country poor in mineral resources.According to relevant data, there are only 12 kinds of minerals in Japan, but as a big economic country, Japan's demand for most mineral products ranks among the top in the world.Many important minerals, Japan is the world's largest or second largest importer.Japan also has a very special and advantageous position in iron ore negotiations.According to the analysis, Japan's position in the global mineral industry today is related to its 40-year overseas resource development policy, which is not only long-term stable, long-term, but also well-organized.So, how did Japan start this development plan?

According to the information on the website of Mitsui & Co., Ltd. of Japan, Mitsui & Co., Ltd. has actively participated in the investment and development of iron ore resources since the 1960s, that is, 40 to 50 years ago.Just when the risk of investing in mineral resources is so great, it has already begun to be developed.In order to obtain a long-term stable supply of iron ore, in 2003, Mitsui & Co., Ltd. acquired a 15% stake in the parent company of Brazil's Vale, the world's largest iron ore, and continued to expand its cooperation with Australia's Rio Tinto and BHP Billiton. ore business.Based on the shareholding ratio owned by Mitsui & Co., Ltd., its current holding output has jumped to the fourth place in the world.That is to say, 40 or 50 years ago, when the demand in the West began to plummet and it was generally believed that mines had no economic value, the Japanese had already begun to enter this market.The Japanese began to purchase iron ore in large quantities. In fact, it was not as simple as purchasing, but they cooperated with the local government to develop and benefit together. So when did we start?We only started buying foreign iron ore in 2002.Every time former Australian Prime Minister Howard visited China, he brought iron ore manufacturers with him, hoping that the Chinese government would buy their iron ore.At that time we were self-sufficient and did not need to import much, but after 2002, the situation was different. Since China has become a big manufacturing country, the demand for iron ore has risen sharply. Therefore, we began to enter this market, and because we did not understand the rules of the game, we suffered a lot of losses. For example, in the case of Rio Tinto, we lost 700 billion yuan .But when we entered the iron ore market in 2002, we didn't understand these at all. Don't say we didn't understand them at the time, we still don't understand them today.Let’s look at the Japanese again. The Japanese entered the industry 40 or 50 years ago when mining resources were a depressed industry.So what is Japan's strategy? Since Japanese iron and steel enterprises have already established a close relationship with the world's major iron ore producers through shareholding and other means, the price of iron ore has continued to rise in recent years, and Japan, an iron ore importer, has even Played the role of pusher.In contrast, China, as the world's largest steel producer, not only has a difficult iron ore negotiation process, but also the average cost of steel mills is 50% higher than that of Japan and Europe.So, how does Japan solve the cost problem in the face of rising prices?In terms of negotiation mechanism, what is the difference between China and Japan?

Japan's strategy is this, they have five steel companies with smelters, but mind you, who are they negotiating with?Steel mills do not negotiate, but trading companies negotiate.There are two trading companies, one is Mitsui & Co., which I just mentioned, and the other is Itochu Trading Company.Mitsui and Itochu are responsible for negotiations with Rio Tinto and BHP Billiton, and Mitsui and Itochu are responsible for sales. Iron and steel enterprises are only responsible for production, so what is the benefit?Mitsui and Itochu have already controlled the price of upstream iron ore, and are also responsible for downstream sales. A large part of steel, called special steel, is sold to China. This is the efficient integration of upstream, midstream, and downstream industrial chains.If the price of iron ore rises and Mitsui and Itochu make money, they will pass some of the profits from the upstream to the steel mills and will not let the steel mills lose money.Then through downstream sales, sell those high-tech products that we can't make, such as special steel, to China, and pass on some of the losses of the steel mills to the downstream.This is how they are integrated. In other words, Japanese trading companies and steel companies are an alliance.What if the price of iron ore falls, steel companies make money, and trading companies lose money?The trading companies are subsidized by steel companies.If the price of iron ore rises and the trading company makes money, the trading company will subsidize the iron and steel enterprises.Through mutual subsidy within the group, each member is guaranteed not to suffer losses.Therefore, the Japanese don't care much about whether the price of iron ore rises or not. If you want to rise, you can go up.And according to the global iron ore pricing mechanism established in 1981-I don't know who stipulated this mechanism, but I now think it is a great conspiracy. According to this pricing mechanism, from the fourth quarter of each year At the beginning, the world's major iron ore suppliers negotiated with customers, and as long as a steel mill reached an agreement, the negotiation ended.And our data shows that Japanese companies are usually the first to reach an agreement. For example, on February 22, 2005, Japan's Nippon Steel and Vale unilaterally reached an agreement to increase the price of iron ore by 71.5%. After the negotiation was over, steel mills all over the world, including China, had to raise their prices according to this agreement. On February 18, 2008, Nippon Steel reached an agreement with Vale to increase prices by 65%, which once again forced Chinese companies to accept such a huge price increase.They raise the price of iron ore, the trading company makes money, and subsidizes the losses of the steel mills; many special steels in Japan are sold to us, and they pass the cost on to China through the price increase of downstream sales. This is what they do.So they don't care about price increases at all, because they have established this alliance as early as 40 or 50 years ago, and through mutual subsidies between trading companies and steel mills, they can safely survive every price increase.Whether the price of iron ore rises or falls, they all make money.This is the strategy that Japan outlined 40 or 50 years ago. What about us?Our Steel Association represents the big steel mills, and there are dozens of small steel mills working on their own.The steel mills are in charge of negotiations, and the steel mills are in charge of sales. Those in charge of negotiations do not understand the rules of the game, how the price of iron ore is determined, or even that the United States is the biggest controller behind it.Therefore, we can’t talk about it. The price of iron ore has increased, and the cost of our steel mills has risen. However, most of the steel we produce is low-to-medium-grade steel, which has no technical content, so we have no bargaining power. It is difficult to raise prices for downstream sales, so In the end suffered a loss. We are completely passive because we have not formed a mechanism like Japan.Why is there no formation mechanism?Because we have always been intoxicated by our reputation as a resource-rich country, we think we have a vast land and resources, and never thought that today, the real resource-poor country is China, not Japan.If not, how could we be so passive in this negotiation?How could a small Rio Tinto cost China 700 billion yuan? According to the usual practice, Rio Tinto and Nippon Steel reached a benchmark price reduction of 33% in the fourth quarter of 2008, and steel mills all over the world, including China, must accept this price reduction.However, the steel association’s subsequent negotiations were dissatisfied with Rio Tinto’s decision to lower the benchmark price by 33%, and believed that China should be lowered even more. Spot prices for imported iron ore.Moreover, our Iron and Steel Association also used our Chinese ability to go through the back door and dig through the wall, bypassing Rio Tinto and directly finding Brazil's Vale to buy iron ore.This is an approach that does not understand the rules of the game. Readers, please think about it. Rio Tinto, BHP Billiton and Vale are of course in the same position. How could we allow us to go through the back door?In the end, Vale blatantly slapped the steel association through the media, announcing that it would not accept the steel association's negotiation. On November 10, 2009, Rio Tinto pointed out that the spot price in China has already been 27% higher than the benchmark price, and this fact will become the basis for next year's negotiations.This signal once again confirmed the previous statement that the three giants demanded a 30% price increase in iron ore negotiations, and once again slapped the Iron and Steel Association for the second time.I would like to ask the Iron and Steel Association, who gave you the power not to negotiate in a fit of anger, thus causing huge losses to our country?